Could Yin be like Yang?

Paul Howard | Analyst | Canaccord Genuity (Australia) Ltd.

____

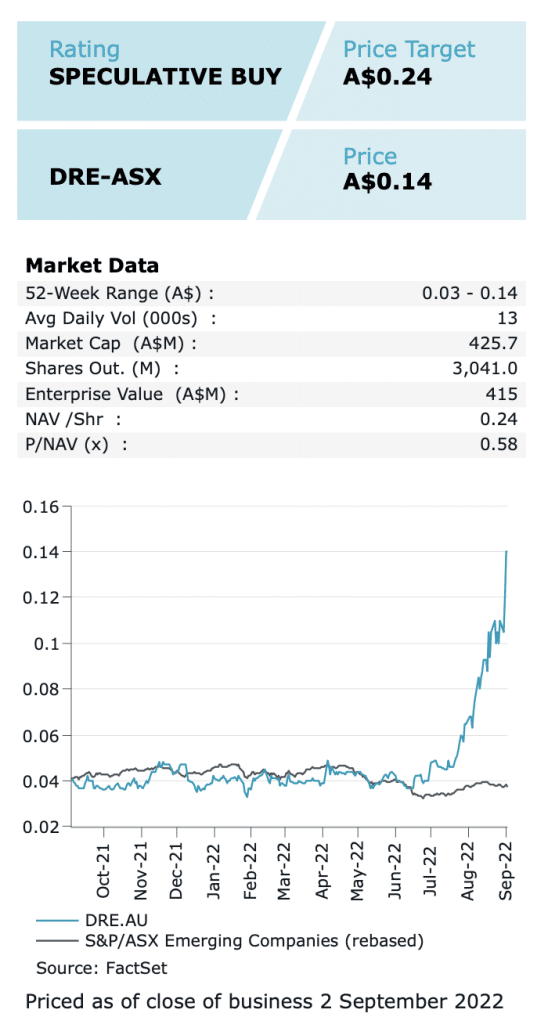

We initiate coverage of DRE with a SPECULATIVE BUY recommendation and a price target of $0.24.

Dreadnought Resources Limited (DRE-ASX) is an Australian-based exploration company whose primary asset is the emerging Mangaroon Project which contains the 100%- owned Yin Rare Earth Element (REE) prospect, located in the Gascoyne Region of WA. Mangaroon and the Yin ironstone and carbonatite targets are located on tenure adjacent to Hastings Technology Metals (HAS-ASX: $5.19 | SPECULATIVE BUY, TP $6.70 | Reg Spencer), which is developing the Yangibana REE Project from similar ironstone horizons with a resource of 27.4Mt @ 0.97% total rare earth oxide (TREO). In our view, the success shown to date by DRE and targets outlined would indicate it has potential to at least replicate the scale defined by HAS.

Immediate REE drill success: In June 2022, DRE commenced drilling the ironstone targets at Yin and releasing thick, high-grade assay results from the first six holes of an initial 120-hole program:

- 35m @ 2.75% TREO from 94m;

- 34m @ 2.59% TREO from surface; and

- 31m @ 1.73% TREO from 24m.

Average NdPr to TREO ratios from DRE’s drilling to date have been ~30%, which is similar to HAS’ Yangibana <25km away. We also note the global average is ~20%. Infill drilling at Yin was completed in August 2022 with assays pending for 114 of the 120 holes completed. A maiden resource is slated for the DecQ’22 and we think it could be 15-20Mt. RC drilling is now ongoing at the Y3 prospect and will then move to Y2 and the carbonatite targets. Initial metallurgical test work (flotation) from outcropping ironstones has yielded a 92.8% recovery and like HAS, the work confirmed recovery of a monazite concentrate.

How big could Yin be: We have taken publicly available drill data from the 120 drill holes at Yin and modelled mineralisation in Micromine. Our interpretation implies a mine inventory of 15-20Mt from the 3km strike already drilled at Yin alone. Note that Yin has been traced for over 16km and DRE also has compelling targets at Y3 and further afield. Suffice to say that a 40Mt resource would appear to be achievable over time, in our view, and this could increase to beyond 50Mt if the carbonatite targets show promise. For now, we centre our valuation on 40Mt and await further success.

Not just a one trick pony: The Mangaroon Project is also prospective for Ni-Cu-

PGEs, with First Quantum Minerals (FM-TSX C$21.01 | BUY, TP C$34.00 | Dalton Baretto, Canaccord Genuity Corp (Canada)) earning up to a 70% interest in a subset of tenements centred around the Money Intrusion. DRE also holds the 100%-owned Tarraji-Yampi Project in the Kimberley (12m @ 1.6% Cu, 32g/t Ag & 0.5g/t Au from 45m at Orion in 2021) as well as the Central Yilgarn Project. Until mid-2022, DRE had equal focus on all three projects; however, given the recent discovery of rare earths at Yin and seasonality in the Kimberley, Yin and the broader REE opportunity at Mangaroon has taken precedent.

Valuation and recommendation: The discovery of REEs at Yin is of great strategic importance in the region and is only the beginning, in our view. Upcoming news flow will include several batches of drill results from Yin as well as updates from drilling at Y3 and the carbonatite targets.

Given the early-stage nature of Mangaroon (Yin) and lack of Mineral Resource, we have opted to use a blend of a Resource multiple and takeover scenario to value DRE. We value the early-stage DRE on an unfunded NAV basis. Our NAV comprises our Yin REE Project valuation weighted 50:50 for a Resource Multiple and 50% takeover premium. We initiate coverage of DRE with a SPECULATIVE BUY recommendation and a price target of $0.24.